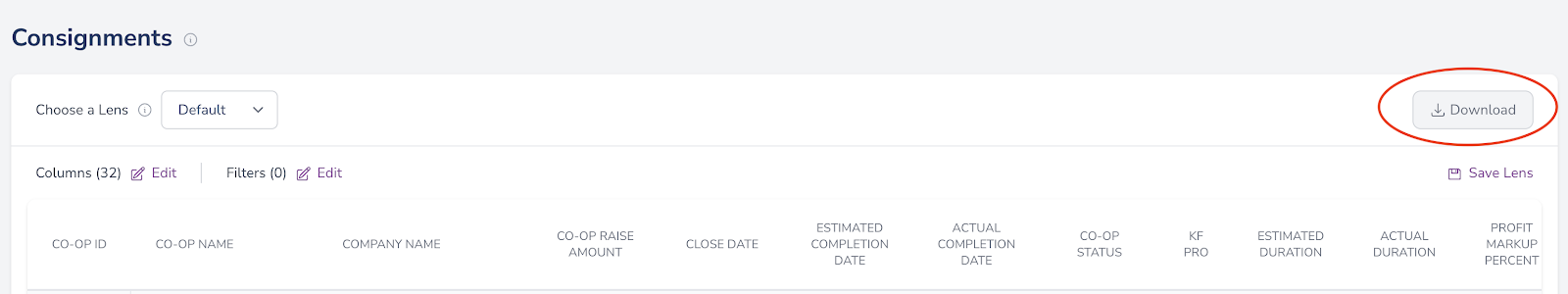

Kickfurther provides a tool for Buyers to help with tax reporting. You can use the tool by logging into your Kickfurther account and then going to your user dashboard and clicking on the consignment tab.

This page allows you to filter your consignment data within a certain date range of your choosing and also gives the ability to download the data via a CSV file at the bottom of the page.

Additionally, as of 2024, Kickfurther has emailed a 1099-K tax form to Buyers that meet the following criteria:

You have received more $20,000 or more in total payouts this year; and

You have received more than 200 total payout transactions.

If you received an online 1099-K tax form from Kickfurther or a request for any additional information, then please promptly complete the form via the email that was sent to you to continue to use the platform.

Please consult a tax reporting professional for assistance in reporting your taxes. If you have questions about reporting taxes on Kickfurther, please feel free to email us by writing to contact@kickfurther.com.